Wall Street stocks sank on Thursday morning, reversing gains from the previous session as markets reassessed the Federal Reserve’s moves to tighten monetary policy in response to inflation.

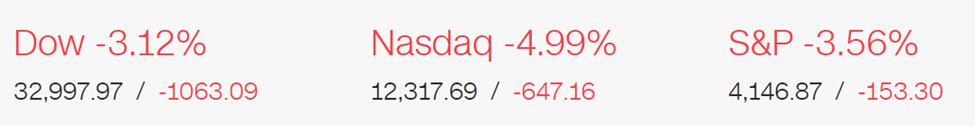

The Dow Jones Industrial Average was down 2.4%, the broad-based S&P 500 fell 3%, while the tech-rich Nasdaq fell 4.1%.

These moves come after a major rally in stocks on Wednesday following the Fed’s interest rate hike announcement.

This is the biggest rate hike in more than two decades, since the last time the US central bank announced a half-point increase was in 2000.

Investors are betting, however, that the Fed can curb inflation without causing a recession.

By sectors, non-essential goods appeared as the most affected (-2.29%), along with technology (-2.13%) and finance (-1.5%).

Among the Dow Jones companies, the losses of Salesforce (-3.29%), Nike (-2.69%), Home Depot (-2.68%) and Microsoft (-2.03%) stood out, while only Chevron (0.68%) and Amgen (0.44%) started positive.

In other markets, Texas oil rose $109.35 a barrel, the 10-year US Treasury bond yield rose to 3.015%, gold rose to $1,901.5 an ounce and the dollar appreciated against the euro., with a change of 1.055.