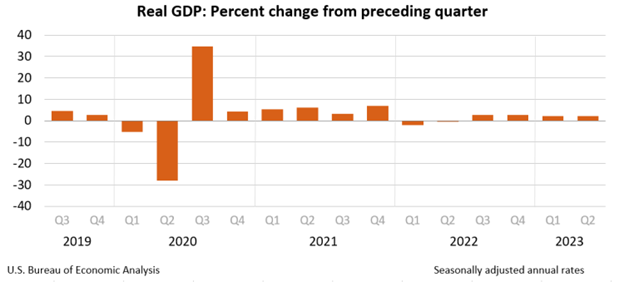

The U.S. economy grew during Q2 2023, blowing past economist expectations and tamping down concerns about a possible recession. Gross domestic product (GDP) grew by a 2.1% compared to Q1 2023. That growth showed a cooling from the 2.6% growth displayed in the quarter before that.

The heightened growth stems from an increase in consumer and government spending, as well as a jump in business investment in inventory, while a decrease in exports and home investment detracted from the GDP growth, according to the Bureau of Economic Analysis.

Personal income — an overall measure of a variety of incomes such as wages and rental payments — grew at a slower pace than it had in the previous quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 5.2 percent, an upward revision of 0.7 percentage point.

Concerns of a recession have loomed over the economy for several months. However, analysts, looking at the decreasing inflation and a strong job market, have become more positive about the U.S. avoiding a recession. Many experts define a recession as two consecutive quarters of economic contraction in a nation’s GDP.

Last week, the Federal Reserve raised interest rates by 0.25%. This move brought the benchmark rate to a 22-year high, ranging between 5.25% and 5.5%. According to a survey conducted by the National Association for Business Economics, nearly 75% of forecasters believe that there is a 50% or lower probability of the U.S. entering a recession in the next 12 months. This announcement was made by the organization on Monday. On Tuesday, the International Monetary Fund unveiled updated projections indicating an improved outlook for both the global and U.S. economies. The IMF now anticipates a 1.8% growth rate for the U.S. economy this year, which represents an upward revision from their previous estimate released in April.