The retail sector is a crucial component of any economy, providing insights into consumer spending patterns and overall economic health. In this economic report, we analyze the performance of various retail categories in March 2023 compared to the same period last year. The data presented offers valuable information on the growth or decline of specific sectors and their impact on the broader economy.

Overall Sector Performance:

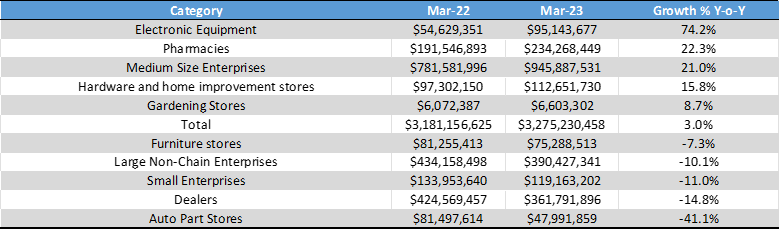

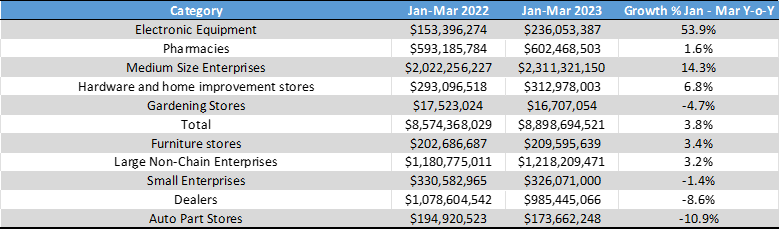

In March 2023, the total retail sector recorded a modest growth rate of 3.0% year-on-year (YoY). The sector’s cumulative performance for the calendar year 2023 showed a slightly higher growth rate of 3.8% compared to the previous year. However, it is essential to delve into the individual retail categories to gain a more comprehensive understanding of the sector’s dynamics.

Winners:

1. Electronics Store: The electronics store category witnessed remarkable growth, with sales soaring by 74.2% YoY in March 2023. The cumulative growth for the calendar year 2023 stood at an impressive 53.9%. This surge indicates a strong demand for electronic goods and reflects the increasing reliance on technology in our daily lives.

2. Pharmacies and Drugstores: This category experienced a healthy growth rate of 22.3% YoY in March 2023. Although the growth was comparatively lower than electronics, the cumulative growth for the year 2023 remained steady at 1.6%. The consistent demand for essential healthcare products and medications contributed to this sector’s resilience.

3. Medium-Sized Retailers: Medium-sized retailers also fared well, with a growth rate of 21.0% YoY in March 2023. The cumulative growth for the year 2023 was recorded at 14.3%. These retailers likely benefited from a combination of factors, including a recovering economy and targeted marketing strategies.

Challenges and Declining Sectors:

1. Auto Parts Stores: Among the retail categories facing challenges, auto parts stores recorded the most significant decline. Sales plummeted by 41.1% YoY in March 2023, with a cumulative decline of 10.9% for the year 2023. This decline could be attributed to factors such as a decrease in vehicle maintenance needs or shifts in consumer preferences.

2. Vehicle Sales: The market for new and used motor vehicles also experienced a substantial decline of 14.8% YoY in March 2023. The cumulative decline for the year 2023 was 8.6%. This decline may be attributed to various factors such as supply chain disruptions, increased prices, or a shift in consumer behavior towards alternative transportation options.

3. Large Non-Chain Stores: Large non-chain stores faced challenges, recording a decline of 10.1% YoY in March 2023. However, the cumulative growth for the year 2023 remained positive at 3.2%. These stores may face increased competition from online retailers and larger chain stores, leading to a decline in sales.

The retail sector in March 2023 showed overall growth, albeit at varying rates across different categories. The electronics and healthcare sectors emerged as clear winners, indicating consumer preferences and trends. On the other hand, challenges were observed in sectors such as auto parts, vehicle sales, and large non-chain stores. These findings reflect the dynamic nature of consumer behavior, economic conditions, and industry trends. Policymakers and industry stakeholders can use this analysis to understand the performance of specific retail categories and make informed decisions to support economic growth and sectoral development.