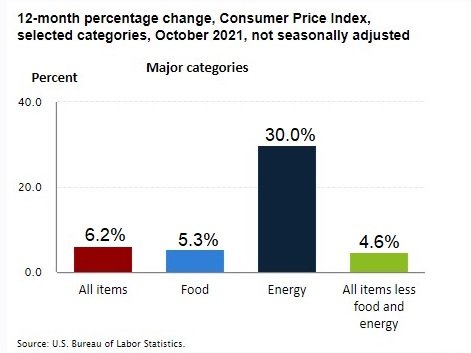

This week, the Labor Department published the Consumer Price Index and prices for U.S. consumers jumped 6.2% in October compared with a year earlier, leaving families facing their highest inflation rate since 1990. The year-over-year increase in the consumer price index exceeded the 5.4% rise in September.

From September to October, prices jumped 0.9%, the highest month-over-month increase since June. With gains broad-based led by energy, food, shelter, and vehicle prices.

The core index, excluding food and energy, rose 4.6%, the sharpest increase since 1991. Food and energy prices are exempt from this calculation because their prices can be too volatile or fluctuate wildly. Core inflation is important because it’s used to determine the impact of rising prices on consumer income. Food prices increased 5.3% while Energy prices increased 30%.

Inflation is eroding the strong gains in wages and salaries that have flowed to America’s workers in recent months.

Driving the price spikes are persistent supply shortages resulting from robust consumer demand and COVID-19-related factory shutdowns coming out of the pandemic recession. Ports across the world have become bottlenecked. America’s employers, facing labor shortages, have also been handing out sizable pay increases, and many of them have raised prices to offset their higher labor costs, thereby contributing to inflation.