In recent news, the crisis of two banks in the United States and one in Europe has had a ripple effect in Puerto Rico. The intervention of federal regulators in Silicon Valley Bank and Signature Bank brought back memories of the 2008 financial crisis and the subsequent crisis that occurred on the island in 2010. However, the federal government has been working to guarantee the deposits of troubled banks through aggressive rate hikes.

The 2008 financial crisis led to the bankruptcy of Lehman Brother and required a billion-dollar bailout to prevent the collapse of the American financial system. In 2010, the Federal Deposit Insurance Corporation (FDIC) carried out a massive consolidation by taking over three banks on the island and merging them with existing banks.

The consolidation resulted in Western Bank, RG Bank, and Eurobank being merged with Banco Popular, Scotiabank, and Oriental Bank, respectively. These failed institutions were rendered insolvent due to aggressive lending policies in the construction and commercial sectors. Doral Bank was also intervened by regulators between 2014 and 2015, with its assets being divided between Banco Popular and Firstbank.

In recent times, Scotiabank and Banco Santander were acquired by Oriental Bank and Firstbank, respectively, with the two global banks deciding to abandon the local market due to the low profitability generated by the struggling local economy. As a result, banking has consolidated dramatically, and there are only five commercial banks operating on the island, including Citibank and Banesco, which primarily focus on commercial financing.

Banking is Profitable and Well Capitalized

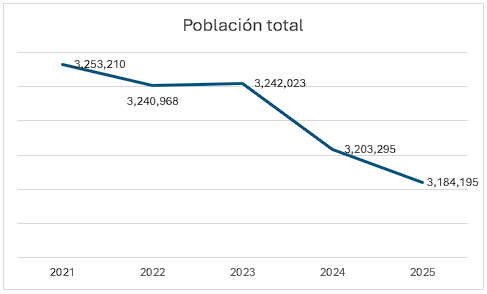

Although the banking system in Puerto Rico has survived a long economic depression and government bankruptcy, it has become much smaller, more well-capitalized, and profitable. In recent times, banks have benefited from economic activity generated by federal funds injected into the economy after Hurricane Maria and the Covid-19 pandemic (2020-2022) stimulus.

Data from the Office of the Commissioner of Financial Institutions (OCIF) shows that, as of the end of 2022, the total assets of banks in Puerto Rico amounted to $98,261 million, while the total capital was $6,444 million, with total profitability of $1,572 million. Banco Popular is the leading institution in the reduced industry, with $67,637 million in assets and a capital of $4,093 million, followed by Firstbank with $18,634 million and a capital of $1,325 million. Oriental Bank is the third banking player, with $9,989 million in assets and a capital of $1,025 million. Banesco-USA operates on the island as a branch of its parent company located in Miami, with assets of $2.8 billion and operating five branches in South Florida. Since 2012, the branch operating on the island has become an option for local businesses and enterprises.