Bankruptcy is a complex phenomenon that has both social and economic implications. In the case of Puerto Rico, it is important to examine the bankruptcy trends and understand their impact on various sectors of the economy. This article analyzes the data on total bankruptcies in Puerto Rico and highlights the significant contributions from industries such as restaurants, dairy farms, pharmacies, security companies, and real estate. Furthermore, it delves into the broader consequences of bankruptcies on the island’s economy.

Bankruptcy Trends in Puerto Rico:

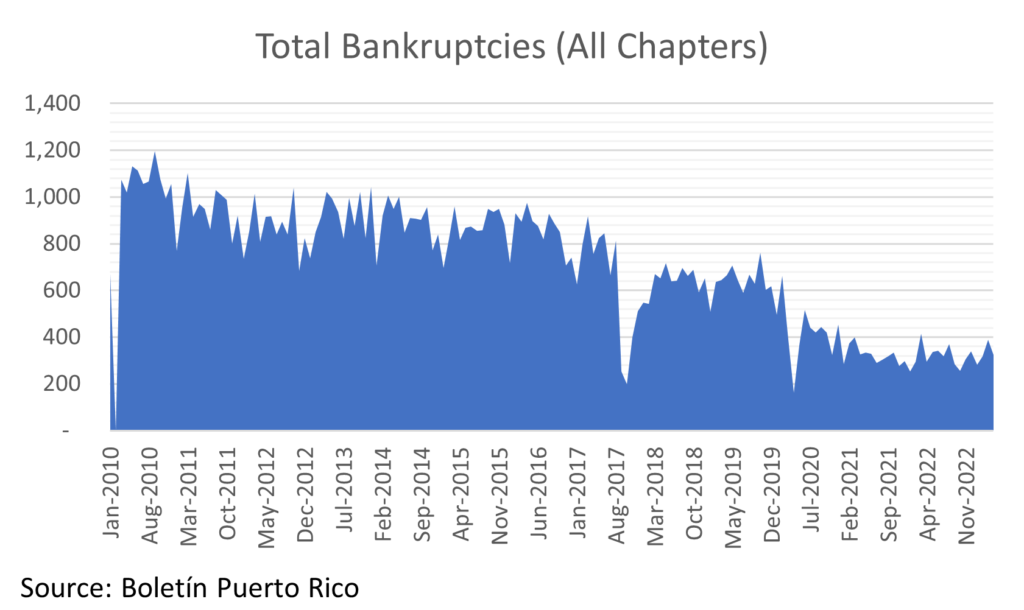

The data on total bankruptcies in Puerto Rico reveals a fluctuating pattern over the past decade. From 2010 to 2014, the number of bankruptcies remained relatively high, with a peak of 1,197 filings in September 2010. However, the numbers started to decline from 2015 onwards, reaching their lowest point of 163 filings in April 2020 during the COVID-19 pandemic. Since then, bankruptcies have shown a gradual increase, reaching 324 filings in April 2023. When comparing year over year in the month of April it has shown an increase of 10.2%.

Top Bankruptcies in Industries as of April 2023:

Several industries have consistently faced financial distress and contributed significantly to the bankruptcy figures in Puerto Rico. Among them are restaurants, dairy farms, pharmacies, security companies, and real estate.

Impact on the Economy:

Bankruptcies have far-reaching effects on the Puerto Rican economy. The repercussions include job losses, reduced consumer spending, increased financial strain on lenders, and a decrease in investor confidence.

1. Job Losses: Bankruptcies often result in layoffs and job losses, affecting not only the employees of the bankrupted businesses but also suppliers and related industries. The impact on employment can exacerbate economic challenges, leading to a decrease in overall productivity and consumer demand.

2. Reduced Consumer Spending: Bankruptcies can lead to reduced consumer confidence and discretionary spending. As individuals and families face financial uncertainty, they tend to prioritize essential purchases, which can have a negative impact on industries reliant on consumer spending.

3. Financial Strain on Lenders: Bankruptcies impose a financial burden on lenders, such as banks and financial institutions, which may have provided loans or credit to the bankrupted businesses. This strain can limit the availability of credit for other businesses, potentially slowing down economic growth and investment.

4. Investor Confidence: Frequent bankruptcies within specific industries can erode investor confidence in those sectors.

In conclusion, the analysis of bankruptcy trends in Puerto Rico highlights the challenges faced by industries such as restaurants, dairy farms, pharmacies, security companies, and real estate. These sectors have experienced financial distress due to various factors. The consequences of bankruptcies extend beyond the affected industries and have a significant impact on the overall economy, including job losses, reduced consumer spending, financial strain on lenders, and diminished investor confidence.

To address these challenges, it is crucial for policymakers, businesses, and stakeholders to prioritize measures that support struggling industries, promote entrepreneurship, and diversify the economy. By implementing strategies such as financial assistance, business support, innovation promotion, and creating a favorable business environment, Puerto Rico can work towards economic recovery and long-term resilience.

Additionally, addressing the underlying issues contributing to bankruptcies and fostering a sustainable economic ecosystem are essential for a prosperous future. By understanding bankruptcy trends and developing effective policies, Puerto Rico can navigate challenges, stimulate economic growth, and build a stable and prosperous economy.