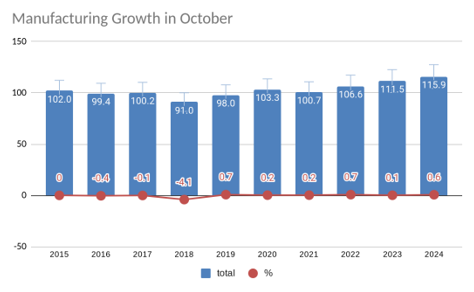

The Index of Coincident Indicators in Manufacturing (IICM) rose to 115.9 in October, according to data from the Office of Business Strategy and Intelligence of the Department of Economic Development and Commerce (DDEC). It is the highest level since March 2009.

When comparing the month of October last year, the Index grew 3.9% and already has 31 months of year-on-year increases. The index increased 0.6% compared to the previous month.

In the first months of the current fiscal year, the index has increased 3.1%, the same increase recorded in the first 10 months of the calendar year.

Headlines:

- Pork sales have increased compared to last year, surveys place consumer preference for local products. Despite the increase in sales, the sector faces a challenge related to the excessive costs that local production entails, due to the increase in the price of raw materials not grown in the country, at the same time that they are not subsidized as happens in other states.

- Long-term mortgage interest rate falls below 7% in the United States, the average long-term mortgage rate in the United States fell below 7% to its lowest level since early August, another boost for would-be homebuyers who have been held back by sharply rising borrowing costs, higher prices, and greater competition for few homes for sale.

- Credit dedicated to consumption grown 14.9% in the second quarter, Consumer loans are the segment that is growing the most within the banks’ portfolio. In the second quarter, personal loans (which include personal loans, auto loans and credit cards) increased 14.9% compared to last year. It is the ninth consecutive increase, according to data from the Office of the Commissioner of Financial Institutions. Loans are $287.3 million higher when compared to the previous quarter.