The economic activity index for Puerto Rico for the month of July came in at 119.2. Compared to the previous month of June, there was a 0.3% increase, while compared to July 2020, there was a 5% increase. After several months of increased recovery in 2020, the economic activity index has stagnated in 2021, hovering between 118.8 and 119.4. Compared to the average for 2019, the index is 3.4% lower.

The most commonly used measure for economic growth is the rate of change in this index compared to the previous year. However, with the sustained period of contraction seen in the index in 2020, current growth figures may be misleading. It is important to contextualize the index relative to where it stood prior to COVID. It has yet to reach this level of economic activity. The index remains lower than before COVID.

The first of the index’s subcomponents, non-farm payroll, reached a total of 855.8 thousand in July. This was the third consecutive month with an increase in this subcomponent. Compared to June, there was a 0.6% increase, while compared with July 2020, there was a 5% increase. Compared to the average for 2019, non-farm payroll is still down by 26.9 thousand, or 3%. Job recovery has been slow in 2021, however, the end of expanded unemployment benefits in September should point towards a faster recovery towards pre-pandemic levels.

The second of the index’s subcomponents, energy generation, came in at 1,633 mm kWh. Compared to the previous month, there was an increase of 8%. Compared to June 2020, there was an increase of 1.9%. The total for this month was 2.4% than average generation in 2019.

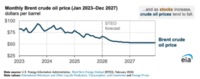

The third of the index’s subcomponents, gasoline consumption, reached a total of 66 million gallons. Compared to the previous month, there was a decrease in consumption of 1.6 million gallons, or 2.4%. Compared to July 2020, there was an increase of 4.2 million gallons, or 6.8%. Compared to 2019, gasoline consumption is still down by 14%. This is the subcomponent that is the furthest from 2019 levels. Increasing oil costs should lead to this subcomponent remaining low for the rest of the year.

The last of the subcomponents, cement sales, reached a total of 1,332 thousand sacks. Compared to the previous month, there was an increase of 11%. Compared to July 2020, there was a decrease of 2.8%. Sales are 18.4% higher than the 2019 average. With billions in federal funds expected to be disbursed in the coming years, we can expect cement sales to remain elevated.

Overall, recovery has slowed down. Employment and gasoline consumption are below 2019 levels and are likely to remain that way for the month of August. While employment can be expected to increase in the final quarter of the year, gasoline consumption will likely remain low, dragging down the index.