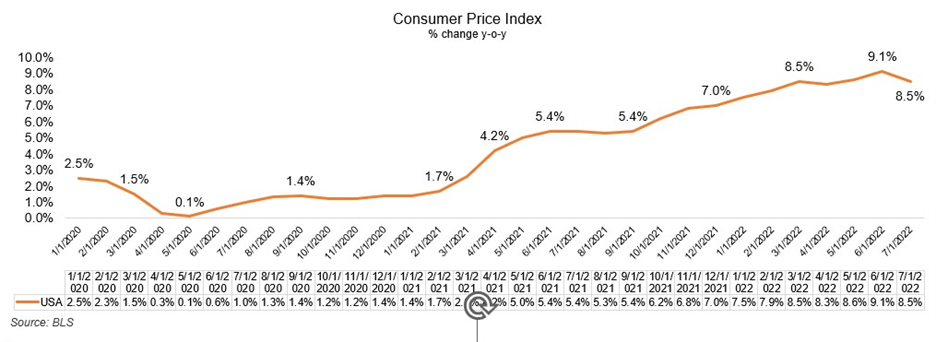

Inflation in the United States fell to 8.5% in July largely because of falling gas and energy prices, suggesting that prices will continue to decline. The figure is down from the 9.1% reached in June, the highest figure since 1981. Inflation between June and July remained stable (0.0).

The largest increases compared to last year occurred in energy (44.9%), food (10.9%), and housing rental (5.7%). Faced with the drop in energy prices, food prices continued to rise, by 1.1% in one month. Core inflation, when food and energy prices that are more volatile are eliminated, was 5.9% from a year ago and remains the same as last month.

Economists had expected inflation to ease from the 9.1% recorded in June. In June, gas pump prices topped $5 a gallon as Russia’s invasion of Ukraine rattled global energy markets. But prices for gasoline, diesel, and other utilities fell steadily in July, offering much-needed relief despite continued high costs for rent, groceries, and the rest.

Wall Street, for its part, opened with a rise of 1.4% after the July inflation reports in the United States. The S&P rose 1.53% at the open, the Dow Jones 1.31%, and the Nasdaq 1.90%.

Families and companies are the ones that have most noticed the relief in their gas and energy bills. The gasoline index fell 7.7% in July, and the energy index fell 4.6%. Airfares fell for the second month in a row and used car prices also fell slightly.