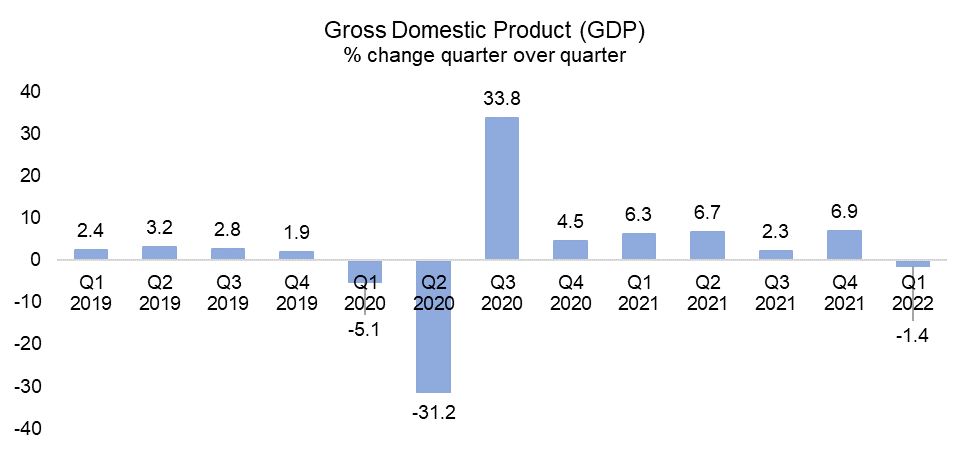

The US economy shrank at a 1.4% annual rate last quarter despite solid spending by consumers and businesses. This is the first contraction since the early days of the pandemic. This is also the first advance estimate so we will likely have a revised number in the following weeks.

Source: BEA

The expectation for growth was low, at 1% but this wasn’t expected. There are a couple of factors, the first being omicron which really at the beginning of the year was significant deadweight on the economy and for the last month of the quarter you had the was in Ukraine and what that did to gas prices. Overall, we’re seeing the effects of inflation in consumer spending but also a lot has to do with inventory reductions.

These inventory reductions are when you end up having a lot of buildup of inventory that counts as part of your gross domestic product even though its sitting in a warehouse, and if you have less, it counts less. Sometimes you have these swings in growth because of inventory, and since the pandemic disrupted the supply chain distribution, this could be one of the factors.

Part of the reduction of the GDP is also that exports are contracting, and the trade deficit is increasing. This is because as demand has increased for durable and non-durable goods, basic goods, which are not mainly made in the US, they’re imported, the trade deficit will increase because agriculture exports, which is the largest part of exports in the US, has remained the same – people are not eating more, but are consuming more durable goods that come from overseas.